Imagine a world where your money isn’t tied to a bank, your transactions are lightning-fast, and you can send funds across the globe as easily as sending an email. Sounds like science fiction, right? Well, welcome to the reality of cryptocurrency!

Cryptocurrency is shaking up the way we think about money. It’s not just tech jargon or a passing trend—it’s a revolution that’s reshaping finance and technology. Whether you’re hearing about Bitcoin for the first time or trying to wrap your head around terms like blockchain and wallets, you’re not alone. Many beginners feel overwhelmed by the complexity, but here’s the good news: you don’t need a tech degree to understand it.

In this guide, we’ll break it all down step by step. By the end, you’ll not only understand what cryptocurrency is but also how it works and why it’s becoming a global phenomenon. This is your crash course in cryptocurrency basics for beginners, made simple and engaging, so let’s dive in!

What Is Cryptocurrency?

Defining Cryptocurrency

At its core, cryptocurrency is digital money. But it’s not just numbers on a screen like the balance in your online banking app. Cryptocurrency is unique because it operates independently of banks or governments. Instead of being controlled by a central authority, it relies on a technology called blockchain—a secure, transparent digital ledger that records transactions across a network of computers.

Here’s a metaphor: think of cryptocurrency as a giant shared notebook. Everyone in the world can see what’s written in it, but nobody can erase or tamper with the notes. Each page in the notebook represents a “block,” and every new transaction adds another page to the book, creating a “chain” of blocks—hence, blockchain.

The most famous cryptocurrency is Bitcoin, often called the “digital gold” of this new financial era. It was created in 2009 by an anonymous person (or group) known as Satoshi Nakamoto. Since then, thousands of other cryptocurrencies have emerged, each with unique purposes and features.

Key Features of Cryptocurrency

Cryptocurrency has several defining traits that set it apart from traditional money. Let’s explore these features:

- Decentralization:

Unlike traditional currencies controlled by central banks, cryptocurrencies are decentralized. This means no single institution governs them, making them resistant to censorship or manipulation. - Anonymity and Privacy:

Cryptocurrencies allow users to make transactions without revealing their personal information. While not entirely anonymous, they offer greater privacy than traditional banking systems. - Security Through Cryptography:

The “crypto” in cryptocurrency refers to cryptography—a complex system of math and algorithms that secures transactions and controls the creation of new coins. - Borderless Transactions:

Sending money via cryptocurrency is like sending an email—it works the same whether the recipient is next door or on the other side of the world. - Limited Supply:

Most cryptocurrencies, like Bitcoin, have a fixed supply. This scarcity helps maintain value over time, similar to precious metals like gold.

Why It Matters: These features make cryptocurrency a game-changer, providing an alternative to traditional financial systems while empowering individuals with more control over their money.

How Does Cryptocurrency Work?

Understanding how cryptocurrency works might feel like cracking a secret code, but it’s actually simpler than you think when broken into steps. At its core, cryptocurrency operates using two main pillars: blockchain technology and cryptographic security. Let’s explore each in detail.

The Role of Blockchain Technology

To understand cryptocurrency, you first need to grasp blockchain technology, the digital backbone that makes it all possible.

Imagine a digital ledger—think of it like an Excel spreadsheet that’s duplicated across countless computers around the world. This ledger tracks every cryptocurrency transaction ever made, ensuring transparency and accuracy. Unlike a regular spreadsheet, blockchain is:

- Distributed: It’s not stored in one central location. Instead, it’s shared across a network of computers (nodes), making it incredibly difficult to hack or alter.

- Immutable: Once a transaction is recorded, it can’t be changed or deleted. This ensures a high level of trust and security.

How it works:

- When someone sends cryptocurrency, a transaction request is created.

- This request is broadcast to the network, where thousands of computers (nodes) validate the transaction using complex algorithms.

- Once verified, the transaction is added to a “block.” Think of a block as a secure folder containing a set of transactions.

- The block is then chained to the previous one, creating a permanent and tamper-proof record.

Real-Life Example: Let’s say Alice wants to send 1 Bitcoin to Bob. The transaction is verified by the blockchain network and added to a block. This block is linked to previous blocks, creating a secure and transparent chain.

Blockchain ensures that everyone agrees on the transaction’s legitimacy without needing a bank or middleman.

Cryptographic Security in Action

The “crypto” in cryptocurrency isn’t just a catchy term—it’s what keeps your digital assets safe and secure. Cryptography uses advanced mathematics to ensure that transactions are both private and trustworthy.

Here’s how it works:

- Public and Private Keys:

- Every cryptocurrency user has a pair of keys:

- A public key, like an email address, which you share with others to receive funds.

- A private key, like a password, which you keep secret to access your cryptocurrency.

- Together, these keys allow you to send and receive funds securely.

- Every cryptocurrency user has a pair of keys:

- Digital Signatures:

- When you send cryptocurrency, your private key generates a unique digital signature for the transaction.

- This signature proves that you authorized the transaction, without revealing your private key.

- Wallets:

- A cryptocurrency wallet is a tool that stores your public and private keys.

- Hot wallets are connected to the internet (e.g., mobile apps), while cold wallets are offline (e.g., hardware devices), offering extra security.

A Simple Analogy:

Think of a public key as your home address—it tells others where to send packages (cryptocurrency). Your private key is the key to your mailbox—it allows you to retrieve those packages but must be kept secret at all costs.

Why Does This Matter?

Blockchain technology and cryptographic security together make cryptocurrency secure, transparent, and trustworthy. They remove the need for middlemen like banks, empowering individuals to control their own money.

Different Types of Cryptocurrencies

The world of cryptocurrency is vast and diverse, with thousands of digital currencies available. While Bitcoin often steals the spotlight as the first and most well-known cryptocurrency, many others play essential roles in the crypto ecosystem. Let’s dive into the different types of cryptocurrencies and what makes each unique.

Popular Cryptocurrencies

- Bitcoin (BTC): The Pioneer

- Launched in 2009, Bitcoin is the original cryptocurrency created by the mysterious Satoshi Nakamoto.

- Often referred to as “digital gold,” Bitcoin is widely regarded as a store of value and an alternative to traditional currencies.

- Its decentralized nature and fixed supply of 21 million coins make it a hedge against inflation.

- Use Case: Peer-to-peer transactions and long-term investment.

- Ethereum (ETH): The Smart Contract Platform

- Launched in 2015, Ethereum introduced the concept of smart contracts, self-executing contracts with the terms directly written into code.

- Ethereum isn’t just a cryptocurrency—it’s a platform for building decentralized applications (dApps).

- Use Case: Powering decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain-based applications.

- Litecoin (LTC): The Silver to Bitcoin’s Gold

- Created in 2011 as a “lighter” version of Bitcoin, Litecoin offers faster transaction times and lower fees.

- It’s often used for smaller, everyday transactions.

- Use Case: Fast and cost-effective payments.

- Ripple (XRP): The Cross-Border Payment Solution

- Ripple is designed for quick and inexpensive cross-border transactions, making it popular with banks and financial institutions.

- Unlike most cryptocurrencies, Ripple operates on a centralized network, which has drawn criticism but also ensures efficiency.

- Use Case: International remittances and business-to-business payments.

Stablecoins and Altcoins

- Stablecoins: The Safe Haven

- Stablecoins are cryptocurrencies pegged to a stable asset like the US dollar or gold. Examples include Tether (USDT) and USD Coin (USDC).

- They offer the stability of traditional currency while retaining the benefits of crypto, such as fast transactions.

- Use Case: Protecting against market volatility and facilitating trading on exchanges.

- Altcoins: Beyond Bitcoin

- “Altcoins” refers to any cryptocurrency that isn’t Bitcoin. This category includes coins with unique technologies, goals, and features.

- Examples of Altcoins:

- Cardano (ADA): Focused on sustainability and scalability in blockchain.

- Polkadot (DOT): Enables different blockchains to work together seamlessly.

- Solana (SOL): Known for its high-speed and low-cost transactions.

- Meme Coins: Fun but Risky

- Meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) started as jokes but gained popularity due to community support and social media hype.

- Caution: These coins are highly speculative and often driven by trends.

Why Understanding Crypto Types Matters

Choosing the right cryptocurrency depends on your goals. Are you looking for a long-term investment? Bitcoin might be your choice. Interested in exploring decentralized finance or NFTs? Ethereum is your go-to. Need to send money overseas quickly? Stablecoins or Ripple might be the answer.

By understanding the different types of cryptocurrencies, you’ll be better equipped to navigate this exciting but complex world.

Why Are People Investing in Cryptocurrency?

Cryptocurrency isn’t just a buzzword—it’s an entirely new way of thinking about money and investment. But why are millions of people worldwide putting their money into this digital frontier? The answer lies in the unique opportunities and challenges that cryptocurrency presents.

Potential Benefits of Cryptocurrency

- High Potential Returns

- Cryptocurrencies are known for their dramatic price increases. For example, Bitcoin’s value skyrocketed from a few cents in 2009 to tens of thousands of dollars today.

- Early investors in coins like Ethereum or Solana saw life-changing gains as these platforms gained traction.

- While there’s no guarantee of success, the potential for massive returns is a significant draw.

- Decentralization and Financial Freedom

- Traditional investments are often tied to banks, brokers, or governments. Cryptocurrency, on the other hand, is decentralized.

- This means you own your assets outright—no middlemen, no intermediaries, just you and your digital wallet.

- This financial autonomy resonates with people seeking greater control over their money.

- Innovation and Emerging Opportunities

- Cryptocurrencies power cutting-edge technologies like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and Web3 applications.

- Investors see crypto as a way to participate in the growth of these transformative trends.

- Borderless and Inclusive

- Cryptocurrency allows people in underserved regions to access global financial systems.

- All you need is a smartphone and an internet connection—no need for a bank account or credit history.

Risks and Challenges

While the potential rewards are high, investing in cryptocurrency comes with its own set of risks.

- Market Volatility

- Cryptocurrency prices are notoriously unpredictable. One day, Bitcoin is hitting record highs; the next, it’s dropping sharply.

- For beginners, this volatility can feel like a rollercoaster ride, making it crucial to invest only what you can afford to lose.

- Security Concerns

- Digital wallets and exchanges can be vulnerable to hacking. While blockchain technology itself is secure, user errors, phishing scams, and weak passwords can put your investments at risk.

- Example: In 2014, the Mt. Gox exchange was hacked, leading to the loss of $450 million worth of Bitcoin.

- Scams and Fraud

- The crypto space is also rife with scams. From fake investment schemes to rug pulls (when developers abandon a project after raising funds), it’s essential to do thorough research.

- Red Flag: If it sounds too good to be true, it probably is.

- Regulatory Uncertainty

- Governments worldwide are still figuring out how to regulate cryptocurrencies.

- While regulation could bring legitimacy and stability, sudden policy changes could impact your investment. For example, countries like China have banned crypto trading, while others, like the US, continue to debate rules.

Why People Still Take the Leap

Despite these challenges, many investors believe the rewards outweigh the risks. Cryptocurrency isn’t just an investment—it’s a bet on the future of money and technology. For some, it’s about profit; for others, it’s about being part of a financial revolution.

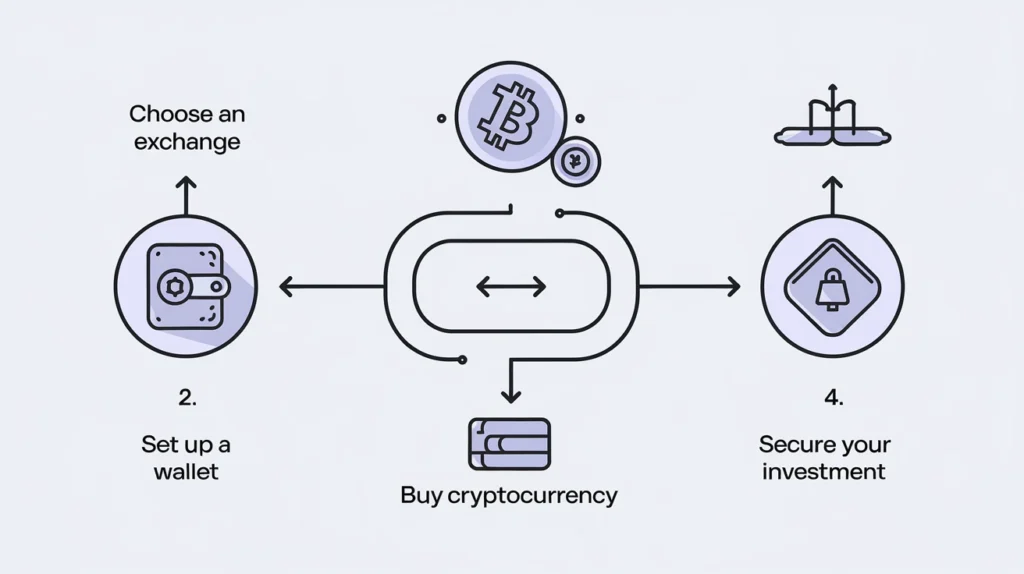

How to Get Started With Cryptocurrency

Stepping into the world of cryptocurrency might feel overwhelming at first, but with the right guidance, you’ll find it’s not as complicated as it seems. Whether you’re looking to make your first purchase or simply learn the ropes, this section will walk you through the essential steps to start your cryptocurrency journey.

Choosing a Cryptocurrency Exchange

A cryptocurrency exchange is like an online marketplace where you can buy, sell, and trade digital currencies. Picking the right exchange is your first step toward entering the crypto world.

Factors to Consider When Choosing an Exchange:

- Reputation and Security:

- Look for exchanges with strong security measures, like two-factor authentication (2FA), cold storage, and encryption.

- Research user reviews and ensure the platform has a clean track record.

- Ease of Use:

- Beginners should prioritize platforms with intuitive interfaces, such as Coinbase or Binance.

- Many exchanges offer tutorials or demo accounts to help new users.

- Fees and Costs:

- Exchanges charge fees for trading, deposits, and withdrawals. Compare these costs to avoid surprises.

- Example: Binance is known for its low fees, while Coinbase may charge more but offers a user-friendly experience.

- Available Cryptocurrencies:

- Make sure the exchange supports the cryptocurrencies you’re interested in, whether it’s Bitcoin, Ethereum, or altcoins.

Popular Exchanges for Beginners:

- Coinbase: Excellent for first-timers, with a simple app and educational resources.

- Binance: Offers a wide variety of cryptocurrencies and low fees.

- Kraken: Known for robust security and a diverse range of coins.

Setting Up a Digital Wallet

Once you’ve chosen an exchange, you’ll need a cryptocurrency wallet to store your digital assets safely. Think of your wallet as a digital safe for your coins.

Types of Cryptocurrency Wallets:

- Hot Wallets (Online):

- Examples: Mobile apps or web-based wallets.

- Pros: Convenient and easy to access.

- Cons: More vulnerable to hacking since they’re connected to the internet.

- Cold Wallets (Offline):

- Examples: Hardware wallets like Ledger or Trezor.

- Pros: Extremely secure, as they are not connected to the internet.

- Cons: Slightly less convenient and usually require an upfront cost.

Steps to Set Up a Wallet:

- Download a wallet app or purchase a hardware wallet.

- Generate your wallet’s unique public key (used for receiving funds) and private key (used for accessing your funds).

- Write down your private key and recovery phrase in a secure location. Never share this information with anyone!

Pro Tip: For small amounts of cryptocurrency, a hot wallet is fine. For larger investments, consider a cold wallet for maximum security.

Safeguarding Your Investment

The crypto world is exciting, but it can also be risky. Protecting your investment should always be a top priority.

Essential Tips for Security:

- Use Strong Passwords:

- Choose a unique, complex password for your exchange and wallet accounts.

- Consider using a password manager to store your credentials securely.

- Enable Two-Factor Authentication (2FA):

- Add an extra layer of security by linking your accounts to an authenticator app like Google Authenticator.

- Beware of Phishing Scams:

- Always double-check URLs before entering your credentials.

- Avoid clicking on suspicious links or downloading unknown attachments.

- Keep Your Private Keys Private:

- Never share your private key or recovery phrase. Scammers often pose as “support agents” to steal this information.

- Diversify and Invest Wisely:

- Don’t put all your money into one cryptocurrency. Diversification can reduce risk.

- Only invest what you can afford to lose—cryptocurrency is highly volatile.

Why Taking These Steps Matters

Starting with cryptocurrency can be as simple or complex as you make it. By choosing a reliable exchange, setting up a secure wallet, and taking the necessary precautions, you’re laying a strong foundation for your crypto journey.

The Future of Cryptocurrency

Cryptocurrency has evolved from a niche interest into a global phenomenon, revolutionizing how we think about money, technology, and finance. While the journey is still in its early stages, the future of cryptocurrency is both exciting and uncertain. In this section, we’ll explore the emerging trends and the challenges that could shape the road ahead.

Trends Shaping Cryptocurrency

- Emergence of Web3

- Web3 represents the next generation of the internet, where blockchain technology underpins a decentralized and user-driven ecosystem.

- Cryptocurrencies like Ethereum power Web3 applications, enabling direct ownership of data and assets without intermediaries.

- Example: Decentralized social media platforms and gaming ecosystems where users earn and trade digital assets.

- Increased Institutional Adoption

- Major companies and financial institutions are embracing cryptocurrency.

- Examples include Tesla accepting Bitcoin payments (briefly), Visa enabling crypto transactions, and banks creating blockchain-based payment systems.

- As adoption grows, cryptocurrencies are becoming more integrated into mainstream finance.

- NFTs (Non-Fungible Tokens): The New Digital Economy

- NFTs have introduced a way to tokenize ownership of art, music, and even virtual real estate.

- Industries like gaming and entertainment are leveraging NFTs to create new revenue streams and immersive user experiences.

- Central Bank Digital Currencies (CBDCs): Bridging the Gap

- Governments worldwide are exploring digital versions of their currencies.

- Unlike decentralized cryptocurrencies, CBDCs are issued and controlled by central banks, offering a bridge between traditional finance and the digital economy.

- Sustainability and Green Initiatives

- With concerns about the environmental impact of energy-intensive blockchain networks, projects like Ethereum’s transition to proof-of-stake (PoS) aim to reduce energy consumption.

- Future trends could see more eco-friendly cryptocurrencies gaining traction.

Challenges to Mainstream Adoption

- Regulatory Uncertainty

- Governments and regulators are still grappling with how to oversee cryptocurrency without stifling innovation.

- Striking a balance between protecting consumers and encouraging growth is a complex challenge.

- Example: Some countries, like El Salvador, have embraced Bitcoin as legal tender, while others, like China, have banned crypto trading.

- Security and Scams

- As the crypto space grows, so do cyber threats. Hacks, scams, and phishing attacks remain significant obstacles to widespread trust.

- Enhancing security measures and educating users will be crucial for the industry’s credibility.

- Volatility and Market Maturity

- Wild price swings make cryptocurrencies less appealing as a stable means of exchange.

- For mainstream adoption, stabilization mechanisms and consumer confidence must improve.

- Public Perception and Education

- Many people still view cryptocurrency as confusing or risky.

- Bridging the knowledge gap with accessible resources and simplified platforms will be vital for broader adoption.

Why the Future of Cryptocurrency Matters

The future of cryptocurrency is about more than money—it’s about creating a more inclusive, decentralized, and innovative world. Whether through Web3, NFTs, or green blockchain solutions, the potential for change is enormous. However, the road to mainstream adoption will require overcoming significant challenges.

Cryptocurrency is more than just a buzzword—it’s a transformative technology reshaping how we think about money, investment, and the internet itself. From Bitcoin’s humble beginnings to the rise of Ethereum, NFTs, and Web3, the crypto ecosystem is filled with opportunities and challenges.

For beginners, understanding what cryptocurrency is and grasping the basics of blockchain can feel daunting, but with the right knowledge and tools, you can confidently take your first steps. Whether you’re intrigued by the potential for financial freedom, excited about the cutting-edge technology, or just curious about what the future holds, cryptocurrency offers a world of possibilities.

As you explore this fascinating digital frontier, remember: take your time, research thoroughly, and approach with caution. Cryptocurrency is as much about innovation as it is about responsibility. By staying informed and proactive, you’ll be well-equipped to navigate this exciting new era.

Are you ready to learn more or dive deeper into the world of cryptocurrency? Share this guide with others starting their journey, and let’s demystify the future of money together!

Additional Online Resources:

- “A Beginner’s Guide to Cryptocurrency” – Investopedia

- “What Is Cryptocurrency?” – CoinDesk

- “The Basics of Bitcoins and Blockchains” – Blockchain.com Learning Center

- “How Cryptocurrency Works” – HowStuffWorks

- “Getting Started with Cryptocurrency” – Binance Academy