Diversification in Financial Planning: Smart Investing

Diversification in financial planning is key to smart investing. It helps manage risk and makes your portfolio stronger. By mixing different types of assets, diversification aims to balance out losses with gains.

This approach is designed to handle the ups and downs of the market. It’s hard to predict which assets will do poorly. The main goal is to reduce risk, not just make more money.

Staying invested for the long term is what matters most. This way, you can enjoy better risk-adjusted returns.

Understanding Diversification in Investing

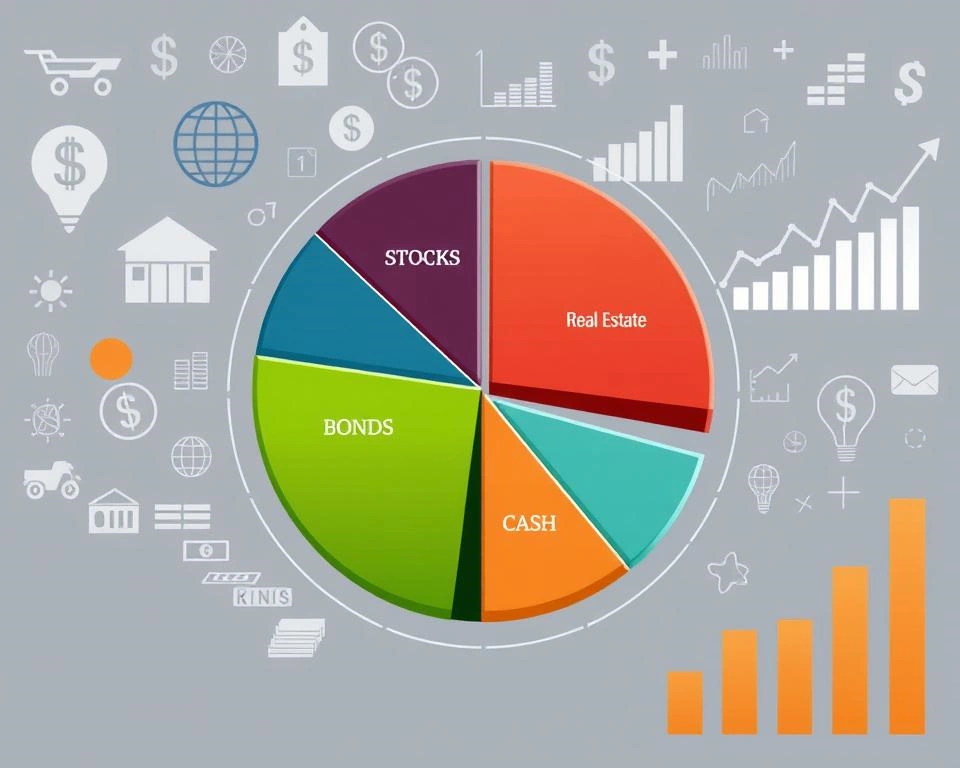

Diversification is key in investing to lower risk. It mixes different types of investments like stocks, bonds, and real estate. The goal is to understand how these investments work together.

What is Diversification?

Diversification means spreading your money across different asset classes. It aims to protect your investments from big losses. By doing this, you can get more stable returns over time.

Research shows that a mix of 25 to 30 stocks can be very effective. This number can vary, as a study in the Journal of Risk and Financial Management found.

Diversification is effective because different investments don’t always move together. When one does poorly, another might do well. This helps balance your portfolio. By diversifying your investments, you can manage risk better and get more stable returns.

Diversifying Across Asset Classes

Creating a balanced investment portfolio is key to managing risk and earning steady returns. Diversifying across different asset classes is a core part of this. You can choose from several main asset classes, such as stocks, bonds, cash, and real assets like property and commodities.

Each asset class has its own risk and return levels. Stocks are often seen as riskier but can offer higher returns. Bonds, on the other hand, are considered safer but may not earn as much. By spreading investments across various classes, you can lower your portfolio’s risk through asset allocation.

Starting with diversification is a good way to build a strong portfolio. Experts say a good portfolio should have at least two asset classes. This helps protect against market swings and keeps your investment portfolio safe from the risks of one type of investment.

When investing in stocks, it’s wise to have a mix of different types. This means owning stocks from various sectors, sizes, and places. For bonds, diversifying means choosing bonds from different issuers with different terms and ratings.

By using smart asset allocation and spreading investments across many classes, you can create a stronger and more balanced investment portfolio. This portfolio is better prepared to handle the ups and downs of the financial markets.

Diversification Within Asset Classes

Diversifying within asset classes is key. It’s called within-asset class diversification. It makes your investment portfolio stronger.

Investing in companies from different sectors is a good way to diversify. This spreads out the risk. It helps your portfolio perform better overall.

For fixed income, mix bonds with different maturities and credit levels. This manages risks like interest and credit. It makes your fixed-income part more stable.

Investing in various mutual funds or ETFs is also smart. It gives you access to many securities and industries. This reduces the effect of any one investment doing poorly.

“Diversification is the only free lunch in investing.” – Harry Markowitz, Nobel Laureate in Economics

Foreign stocks have been the top performers over 30 years, with 12 winning years. Stocks and foreign stocks have won more often than cash and bonds in the last three decades.

Using within-asset-class diversification strategies can improve your portfolio’s risk-return balance. This can lead to more stable and consistent returns over time.

Diversification in Financial Planning

Diversification is key in financial planning. It helps manage risk management and keeps wealth preservation strong. By spreading investments, people can get better returns, even when markets change.

Spreading investments across different types is smart. Stocks and bonds often move in opposite ways. This means one can balance out the other’s losses. So, a mix of assets makes a portfolio stronger.

“Proper diversification is crucial for successful investing. It allows investors to absorb dips in performance and reduces the need to sell low and accept major losses.” – NerdWallet

Also, diversifying a portfolio limits big losses. It doesn’t promise profits or remove all risks. Yet, experts say it’s a top way to handle risk management and keep wealth preservation goals in sight.

In short, financial planning with a diverse investment portfolio is wise. It helps deal with market ups and downs. By using diversification, investors can make their wealth preservation efforts more stable and strong.

Rebalancing for Optimal Diversification

Even the best investment portfolios need portfolio rebalancing now and then. This keeps the mix of assets right. When some assets grow and others fall, the mix can get off track. This can lead to more market volatility and risk.

Rebalancing is key to keeping your asset allocation in check. It helps you stay on track with your financial goals and how much risk you can handle.

Rebalancing is the process of adjusting your investment portfolio to maintain your target asset allocation, ensuring optimal diversification and risk management. Over time, market fluctuations can cause your portfolio to drift from its original mix, potentially exposing you to more risk or lower returns than intended. Rebalancing helps realign your investments with your financial goals and risk tolerance.

📊 Why Rebalancing Matters

- Maintains Risk Level:

- Without rebalancing, a portfolio may become too heavily weighted in high-risk assets (like stocks) during a market rally, increasing your exposure to volatility.

- Rebalancing restores your original risk profile (e.g., 60% stocks / 40% bonds).

- Locks in Gains:

- By selling assets that have performed well and buying those that haven’t, rebalancing helps you lock in profits and avoid overexposure to overvalued assets.

- Promotes Disciplined Investing:

- Rebalancing helps you avoid emotional decisions by adhering to a systematic approach, buying low and selling high.

- Improves Diversification:

- Ensures your portfolio remains diversified across asset classes, sectors, and regions, reducing the risk of concentration.

🔄 When to Rebalance

1. Time-Based Rebalancing

- Frequency: Quarterly, semi-annually, or annually.

- This method is straightforward and ensures regular check-ins without reacting to market noise.

2. Threshold-Based Rebalancing

- Trigger Points: When an asset’s allocation deviates by a set percentage (e.g., 5% or 10%).

- This approach ensures you act when there’s a significant shift rather than on a fixed schedule.

3. Hybrid Approach

- Combination: Check your portfolio regularly (e.g., annually) and rebalance only if allocations exceed a set threshold.

- Balances discipline and flexibility.

There are times when you might need to rebalance your portfolio:

- Significant market volatility – Big changes in asset values call for rebalancing.

- Life events – Big life changes, like retirement, might mean you need to rebalance.

- Predetermined schedules – Some people rebalance regularly, like every year or two, to keep their asset allocation right.

Rebalancing means moving money to where it’s needed more. You might add to weak areas or sell strong ones. This helps manage risk and keeps your portfolio in line with your investment strategy.

🛠️ Steps to Rebalance Your Portfolio

- Review Your Target Allocation:

- Reaffirm your desired mix (e.g., 70% stocks, 20% bonds, 10% cash) based on your risk tolerance and goals.

- Assess Current Allocation:

- Analyze how your current holdings compare to your target.

- Identify Overweight and Underweight Assets:

- Overweight: Assets that have grown beyond their target percentage.

- Underweight: Assets that have fallen below their target.

- Sell Overweight Assets:

- Sell a portion of assets that have performed well to bring their weight back to the target.

- Buy Underweight Assets:

- Use the proceeds to invest in assets that are below their target allocation.

- Consider Tax Implications:

- Be mindful of capital gains taxes in taxable accounts.

- Prioritize rebalancing in tax-advantaged accounts (e.g., IRAs, 401(k)s) when possible.

- Review Fees and Costs:

- Account for transaction fees when selling and buying investments.

- Reinvest Dividends:

- Use dividends and interest payments to help rebalance gradually by allocating them to underweight assets.

📈 Examples of Rebalancing Scenarios

📝 Example 1: Stock Market Boom

- Original Allocation: 60% Stocks / 40% Bonds

- Current Allocation: 75% Stocks / 25% Bonds (due to stock market growth)

- Action: Sell stocks and buy bonds to return to 60/40.

📝 Example 2: Market Downturn

- Original Allocation: 70% Stocks / 30% Bonds

- Current Allocation: 55% Stocks / 45% Bonds (due to falling stock prices)

- Action: Sell bonds and buy stocks to return to 70/30.

💡 Best Practices for Rebalancing

- Set Clear Targets:

- Define your target asset allocation based on goals and risk tolerance.

- Stay Consistent:

- Choose a regular schedule or threshold and stick to it.

- Automate When Possible:

- Some investment platforms allow automatic rebalancing.

- Keep Costs Low:

- Use tax-efficient strategies and low-fee investments to minimize costs.

- Don’t Over-Rebalance:

- Too-frequent rebalancing can lead to excessive fees and taxes. Aim for once or twice a year unless the market is unusually volatile.

- Diversify Within Assets:

- Rebalance not just across asset classes but within them (e.g., different sectors, regions, and investment types).

🔎 Common Mistakes to Avoid

- Ignoring Taxes:

- Be aware of the tax impact when selling investments in taxable accounts.

- Emotional Decisions:

- Avoid panic-selling or market-timing; follow a disciplined rebalancing plan.

- Rebalancing Too Often:

- Excessive trading can reduce returns due to fees and taxes.

- Overlooking Correlations:

- Ensure your diversified assets don’t all move in the same direction during market shifts.

✅ Key Takeaways

- Rebalancing maintains your desired asset allocation and risk level.

- Time-based and threshold-based approaches can suit different needs.

- Rebalancing ensures long-term discipline, helps lock in gains, and improves diversification.

- Consider taxes, fees, and market conditions to rebalance effectively.

By implementing a consistent rebalancing strategy, you can keep your portfolio aligned with your financial goals and risk tolerance, optimizing long-term performance and reducing risk.

“Rebalancing is a negotiation between risk and reward that can help your portfolio stay on track amidst market highs and lows.”

Regular rebalancing keeps your diversification strong. It helps you avoid big losses and aims for steady, consistent returns over time.

Risk Tolerance and Diversification Strategies

Creating a good investment plan means knowing your risk level and picking the right diversification methods. Your risk tolerance comes from your investment time, financial goals, and past experiences. It’s key to finding the best mix of investments for you.

People with longer investment times can handle more risk. They have more time to deal with market ups and downs. Aggressive investors might put 90% in stocks and 10% in bonds. Moderate ones might choose 70% stocks and 30% bonds. And the most cautious might go for a 50/50 split.

Diversifying your investments is a smart way to manage risk. It spreads your money across different types of investments. This helps reduce the impact of market swings and helps you reach your financial goals.

It’s wise to talk to a financial advisor to find the right diversification for you. They can help based on your risk level and how long you plan to invest. With their help, you can create a portfolio that meets your financial goals and sets you up for success in the long run.

“Diversification is the only free lunch in investing.”

– Harry Markowitz, Nobel Laureate in Economics

Risk Tolerance and Diversification Strategies are two critical concepts in financial planning and investing. Together, they help you create a balanced and effective investment portfolio that aligns with your financial goals and comfort level.

📊 Understanding Risk Tolerance

Risk Tolerance is your ability and willingness to endure potential losses in your investments. It is influenced by several factors:

- Financial Goals:

- Short-term goals (e.g., buying a home within 3 years) typically favor lower-risk investments like bonds or cash equivalents.

- Long-term goals (e.g., retirement in 20+ years) can tolerate higher risk, such as stocks or real estate, because there’s more time to recover from market downturns.

- Time Horizon:

- The longer you have until you need your money, the more risk you can take.

- A shorter time frame requires more conservative investments to protect capital.

- Personal Comfort with Volatility:

- Some investors lose sleep over market swings, while others are unfazed.

- Your comfort level helps determine how much risk you should take.

- Current Financial Situation:

- If you have a steady income and an emergency fund, you may afford to take more risk.

- If your finances are tight, a conservative approach may be wiser.

- Investment Knowledge:

- Experienced investors may feel comfortable with complex, high-risk assets.

- Beginners often prefer straightforward, lower-risk options.

🛠️ Diversification Strategies

Diversification helps manage risk by spreading investments across various assets. The goal is to reduce exposure to any single investment or asset class, minimizing the impact of a poor-performing investment.

Here are effective diversification strategies based on risk tolerance:

1. Asset Class Diversification

- Conservative Investor (Low Risk Tolerance):

- Portfolio Mix: 70% Bonds, 20% Stocks, 10% Cash.

- Focus on stability, low volatility, and steady returns.

- Moderate Investor (Medium Risk Tolerance):

- Portfolio Mix: 50% Stocks, 40% Bonds, 10% Cash.

- Balance between growth and protection.

- Aggressive Investor (High Risk Tolerance):

- Portfolio Mix: 80% Stocks, 10% Bonds, 10% Alternatives (e.g., real estate, commodities).

- Emphasis on high growth, accepting more volatility.

2. Sector Diversification

Invest in different industries to avoid concentration risk. For example:

- Technology

- Healthcare

- Finance

- Energy

- Consumer Goods

This ensures your portfolio isn’t too dependent on one sector’s performance.

3. Geographic Diversification

Invest across:

- Domestic Markets: Stability and familiarity.

- International Markets: Exposure to global growth and reduced dependence on one country’s economy.

- Emerging Markets: Higher risk but potential for greater growth.

4. Investment Vehicle Diversification

Use a mix of:

- Stocks: Growth potential, higher volatility.

- Bonds: Steady income, lower risk.

- ETFs/Index Funds: Broad market exposure, cost-effective.

- Real Estate: Tangible assets, hedge against inflation.

- Commodities: Diversify against market downturns.

5. Time-Based Diversification

- Dollar-Cost Averaging: Invest a fixed amount regularly (e.g., monthly) to reduce the impact of market volatility over time.

6. Alternative Investments

For high-risk tolerance investors, consider:

- Private Equity

- Hedge Funds

- Cryptocurrencies

- Commodities

These can enhance diversification but come with higher risk.

🔄 How Risk Tolerance and Diversification Work Together

- Tailored Strategy:

- Your diversification strategy should match your risk tolerance.

- A conservative investor should prioritize bonds and dividend stocks.

- An aggressive investor can invest more heavily in growth stocks and alternatives.

- Portfolio Rebalancing:

- Over time, market fluctuations can shift your asset allocation. Rebalancing periodically ensures your portfolio aligns with your risk tolerance.

- Avoid Over-Diversification:

- While diversification reduces risk, owning too many investments can dilute returns and make management cumbersome.

- Adapt Over Time:

- As your financial goals, life situation, and risk tolerance change, adjust your diversification strategy accordingly.

✅ Key Takeaways

- Know Your Risk Tolerance: Assess your financial goals, time horizon, and comfort level with risk.

- Diversify Wisely: Spread investments across assets, sectors, and regions to manage risk.

- Rebalance Regularly: Ensure your portfolio stays aligned with your intended risk level.

By combining risk tolerance with smart diversification, you create a resilient investment strategy that supports both growth and financial security.

The Benefits of Diversified Investing

Managing Risk and Generating Consistent Returns

Diversified investing helps manage risk and get steady returns over time. It spreads your money across different types of investments. This way, your portfolio is safer from big losses in any one area.

A diversified portfolio makes your investment journey smoother. It has fewer big ups and downs. This is because different investments react differently to economic changes.

Starting with just a few dollars a month can help you build a diversified portfolio. It’s especially good for older investors close to retirement. They need to protect their money from market swings.

“Diversification is the only free lunch in investing.”

– Harry Markowitz, Nobel Laureate in Economics

Diversification can’t get rid of all market risk. But it can lessen the impact of risk in specific areas. This leads to more steady returns, even when markets are unpredictable.

Adding diversified investing to your strategy is wise. It helps manage risk and generate consistent returns.

Implementing Diversification in Your Portfolio

Building a diversified portfolio is key to good financial planning. By investing in many asset classes, investment vehicles, and fund selections, you manage risk well. This helps you reach your investment goals.

Investing in stocks, bonds, real estate, and things like gold can help. This asset allocation spreads your risk. It makes your portfolio less affected by any one investment’s ups and downs.

- Mutual funds and exchange-traded funds (ETFs) are great for diversifying. They hold many securities in one investment. This lets you easily get into many markets with just one buy.

- Choose funds that cover different investment styles and sectors. Also, pick ones that span various geographic regions.

- Keep your portfolio balanced by rebalancing it. This makes sure your asset allocation stays right over time.

Diversification doesn’t mean you won’t lose money. But it can lower your risk and make your returns more stable over time. A diversified strategy builds a solid base for your financial future.

“Diversification is the only free lunch in investing.” – Harry Markowitz, Nobel Laureate in Economics

Diversification is key to smart investing. It helps manage risk and makes portfolios stronger. While it might seem less exciting than chasing high returns, it offers steady growth and safety.

By spreading investments across different types, investors can reach their goals. This could be saving for retirement, keeping wealth safe, or cutting taxes. A well-diversified portfolio is essential for these aims.

Studies prove that diversified portfolios do better over time. Keeping the portfolio balanced is important. This ensures it matches the investor’s risk level and goals.

As diversification methods grow, so does the chance to create custom plans. Thanks to new tech, these plans are more accurate. This is due to better data analysis and AI.

Diversification is at the heart of good financial planning. It lowers risk, stabilizes earnings, and helps reach long-term goals. It’s a key tool for those wanting to grow and keep their wealth safe.

As the financial world changes, a diversified portfolio is more important than ever. It’s the backbone of a strong investment strategy.

30 Tips on Diversification in Financial Planning

Diversification is a cornerstone of prudent financial planning, aiming to balance risk and reward by spreading investments across various assets.

- Assess Your Risk Tolerance: Understand your comfort with potential losses to tailor your diversification strategy appropriately.

- Determine Your Investment Horizon: Align your asset allocation with your time frame for needing the funds.

- Allocate Across Asset Classes: Invest in a mix of stocks, bonds, and cash equivalents to spread risk. Fidelity

- Diversify Within Asset Classes: Within each asset class, spread investments across different sectors and industries.

- Include International Investments: Investing globally can reduce risk associated with any single country’s economy. Fidelity

- Consider Alternative Investments: Assets like real estate, commodities, or infrastructure can provide additional diversification. Business Insider

- Use Low-Cost Index Funds or ETFs: These can offer broad market exposure and diversification at a lower cost. Forbes

- Regularly Rebalance Your Portfolio: Adjust your holdings periodically to maintain your desired asset allocation. Vanguard Investor

- Avoid Overconcentration: Ensure no single investment disproportionately affects your portfolio’s performance.

- Be Mindful of Correlations: Choose assets that don’t move in tandem to enhance diversification benefits.

- Consider Tax Implications: Diversify across accounts (taxable, tax-deferred, tax-free) to optimize after-tax returns.

- Stay Informed About Market Conditions: Economic shifts can impact asset correlations and diversification effectiveness.

- Understand the Role of Bonds: Bonds can provide stability, but their performance may correlate with stocks during certain economic conditions. Business Insider

- Don’t Chase Performance: Avoid reallocating assets based solely on recent high returns of a particular sector.

- Maintain Liquidity: Keep a portion of your portfolio in liquid assets to meet short-term needs without forced selling.

- Diversify Across Market Capitalizations: Include small, mid, and large-cap companies to capture different growth potentials.

- Incorporate Defensive and Cyclical Stocks: Balance your portfolio with stocks that perform differently across economic cycles.

- Utilize Dollar-Cost Averaging: Investing fixed amounts regularly can reduce the impact of market volatility.

- Consider Professional Guidance: Financial advisors can help tailor diversification strategies to your goals.

- Be Wary of Home Bias: Avoid overinvesting in domestic markets; global diversification can enhance returns.

- Understand Sector Exposure: Ensure your portfolio isn’t overly concentrated in a single sector.

- Monitor and Adjust for Life Changes: Major life events may necessitate changes in your diversification strategy.

- Educate Yourself Continuously: Stay updated on diversification strategies and market developments.

- Avoid Market Timing: Attempting to predict market movements can lead to poor diversification decisions.

- Consider Environmental, Social, and Governance (ESG) Factors: Incorporating ESG criteria can add a layer of diversification.

- Be Patient: Diversification is a long-term strategy; avoid making frequent, impulsive changes.

- Use Technology and Tools: Leverage financial software to analyze and maintain diversification.

- Understand the Costs: Be aware of fees associated with various investments, as they can impact diversification benefits.

- Review Employer Stock Holdings: Ensure company stock doesn’t constitute too large a portion of your portfolio.

- Plan for the Unexpected: Diversify to protect against unforeseen events that could impact specific investments.

Implementing these strategies can help you build a resilient portfolio tailored to your financial objectives and risk tolerance.

Key Takeaways

- Diversification is a core strategy for managing investment risk and preserving wealth.

- Asset allocation among different asset classes, such as stocks, bonds, and cash alternatives, is crucial for diversification.

- Diversifying within asset classes, such as by company size, sector, and geographic location, can further enhance portfolio resilience.

- Rebalancing the portfolio periodically is necessary to maintain the desired asset allocation and diversification levels.

- Aligning diversification strategies with individual financial goals, risk tolerance, and time horizon is essential for optimal results.

References & Resources on Diversification in Financial Planning

Articles and Guides:

- Fidelity – Guide to Diversification

Guide to Diversification - Investopedia – Diversification Definition

Diversification Explained - Morningstar – The Basics of Diversification

Morningstar Guide - Vanguard – Diversifying Your Portfolio

Vanguard’s Diversification Tips - Forbes – The Importance of Diversification

Forbes Investment Guide - Charles Schwab – How to Diversify Your Portfolio

Diversification Insights - U.S. News – Investment Diversification Strategies

U.S. News Guide - CNBC – Diversification Strategies for Investors

CNBC Investment Tips - The Balance – Diversifying Your Investment Portfolio

The Balance Article - NerdWallet – Portfolio Diversification Explained

NerdWallet Guide

Books and eBooks:

- “The Intelligent Asset Allocator” by William J. Bernstein

Goodreads Review - “A Random Walk Down Wall Street” by Burton G. Malkiel

Amazon Link - “The Little Book of Common Sense Investing” by John C. Bogle

Goodreads Review

Financial Platforms and Tools:

- Morningstar – Portfolio Analysis Tool

Portfolio Manager - Yahoo Finance – Investment Diversification Analysis

Yahoo Finance Tools - Personal Capital – Investment Checkup Tool

Personal Capital Tools

Research Reports and Whitepapers:

- BlackRock – Diversification Strategies Report

BlackRock Insights - J.P. Morgan – Guide to the Markets

J.P. Morgan Guide

Educational Platforms:

- Khan Academy – Investment Diversification Lessons

Khan Academy Course - Coursera – Investment Management Courses

Coursera Investment Courses